Leveraged investing is a technique that seeks higher investment profits by using borrowed money. These profits come from the difference between the investment returns on the borrowed capital and the cost of the associated interest. Leveraged investing exposes an investor to higher return with high risk.

Watch the video below from Industrial Alliance and B2B:

Read attached to understand how investment leveraging works and IA loan criteria.

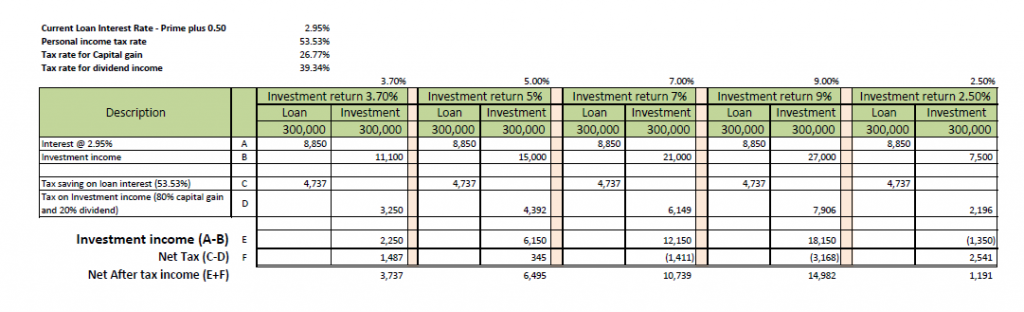

Below is an example showing net after tax income of borrowing and investing $300,000 at various expected rate of return. Even with a rate of return of 2.5%, you are breakeven if you’re at the highest marginal tax rate.

If you have any questions, please feel free to contact us.