The TFSA program began in 2009. It is a way for individuals who are 18 years of age or older and who have a valid social insurance number (SIN) to set money aside tax free throughout their lifetime.

Unlike an RRSP, investors are not able to deduct contributions to a TFSA for tax purposes; however investment income and capital gains earned within the TFSA, will generally not be subject to tax, even when the funds are ultimately withdrawn.

Administrative or other fees in relation to a TFSA and any interest on money borrowed to contribute to a TFSA are not tax-deductible.

A person determined to be a non-resident of Canada for income tax purposes can hold a valid SIN and be allowed to open a TFSA, however, any contributions made while a non-resident will be subject to a 1% tax for each month the contribution stays in the account.

At any time in the year, if you contribute more than your allowable TFSA contribution room, you will be considered to be over-contributing to your TFSA and you will be subject to a tax equal to 1% of the highest excess TFSA amount in the month, for each month that the excess amount remains in your account.

Withdrawals made from your TFSA in the year will only be added back to your TFSA contribution room at the beginning of the following year.

Note: Income generated on TFSA investments outside Canadian funds is still taxable in that other country.

You will accumulate TFSA contribution room for each year even if you do not file an Income Tax and Benefit Return or open a TFSA.

The annual TFSA dollar limit for the year 2025 is $7,000.

The TFSA annual room limit will be indexed to inflation and rounded to the nearest $500.

Accumulated TFSA limit since program began in 2009 including year 2025 is $102,000

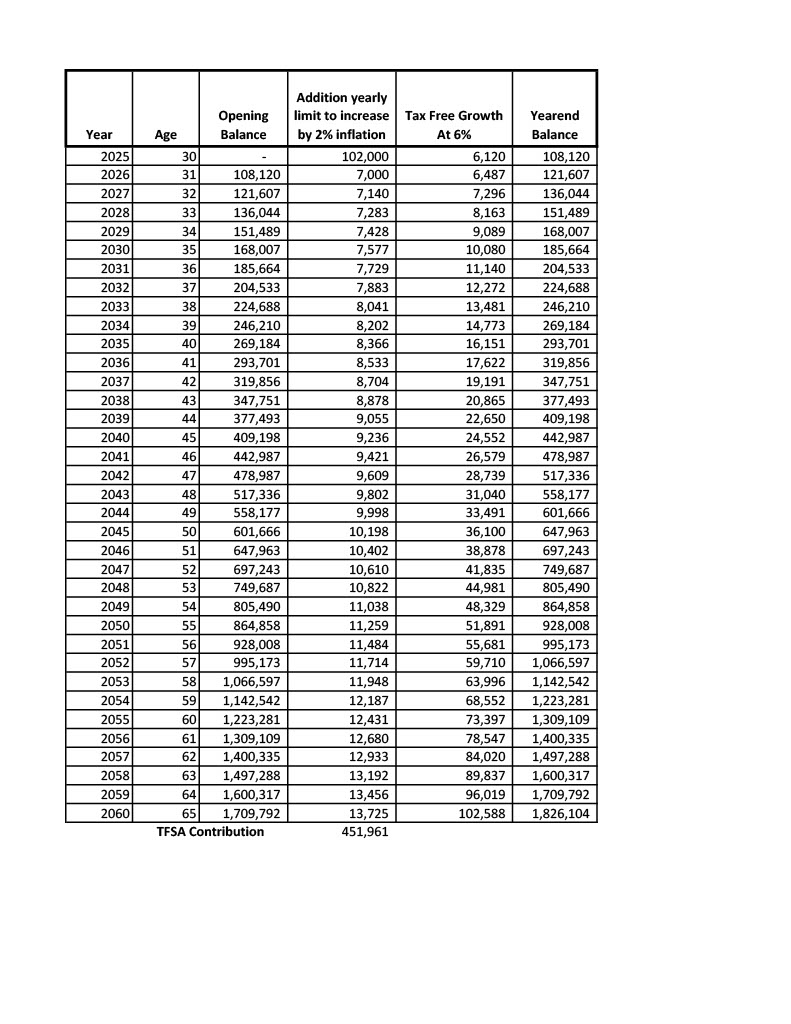

TFSA limit is not only increased by set annual indexed amount, but also increased by growth within the TFSA. A person 30 years of age will have $451,961 TFSA limit at age 65 if he or she had not contributed to TFSA during lifetime. However, by contributing maximum allowable amount each year he or she can increase the TFSA limit to more than million dollars.

Example 1

Tom is 30 years of age and a Canadian resident. His wife is also 30 years of age and a Canadian resident. They never contributed to TFSA since the program started in year 2009 and therefore they have TFSA contribution room of $102,000 each. It is assumed that the annual limit increase will indexed by 2% to their age 65. As per the example below if they contribute maximum amount available each year, they each will have $1.826M in their TFSA investment at age 65 with 6% annual return. Therefore they each can earn $102,588 non-taxable income at age 65 i.e. $205,176 non-taxable family income.

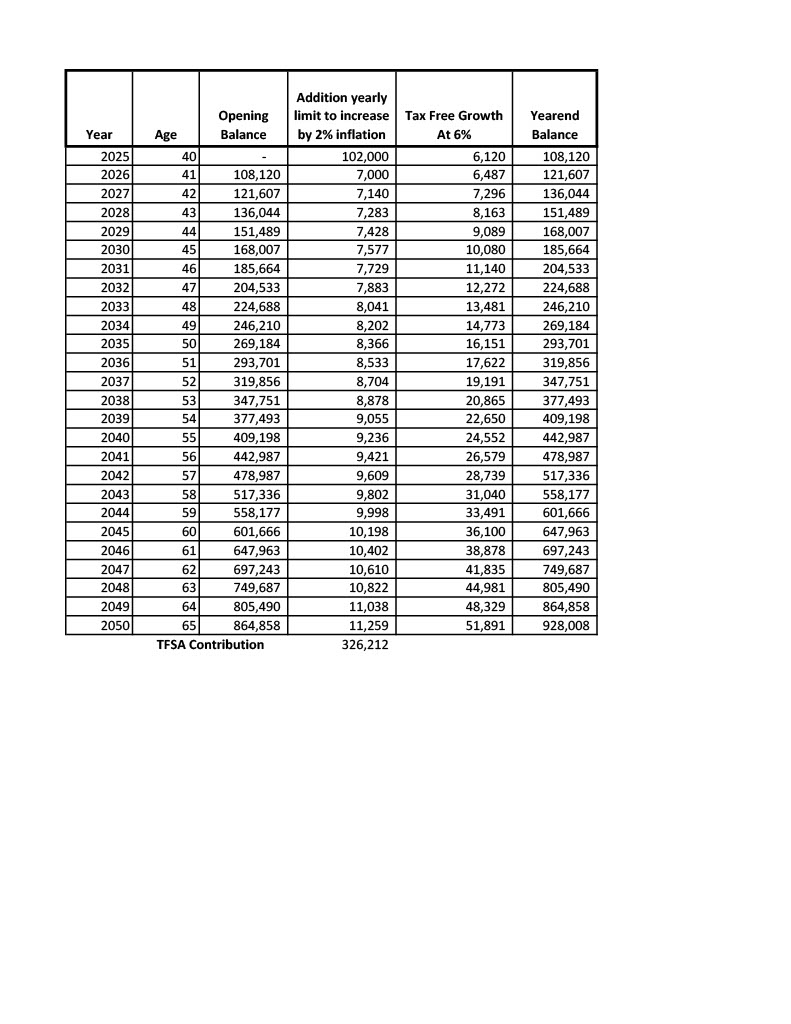

Example 2

With same above example assuming Tom and his wife are 40 years of age and a Canadian resident.