2017 Personal & Corporate Tax Updates – Rajesh Arora, CPA, CGA

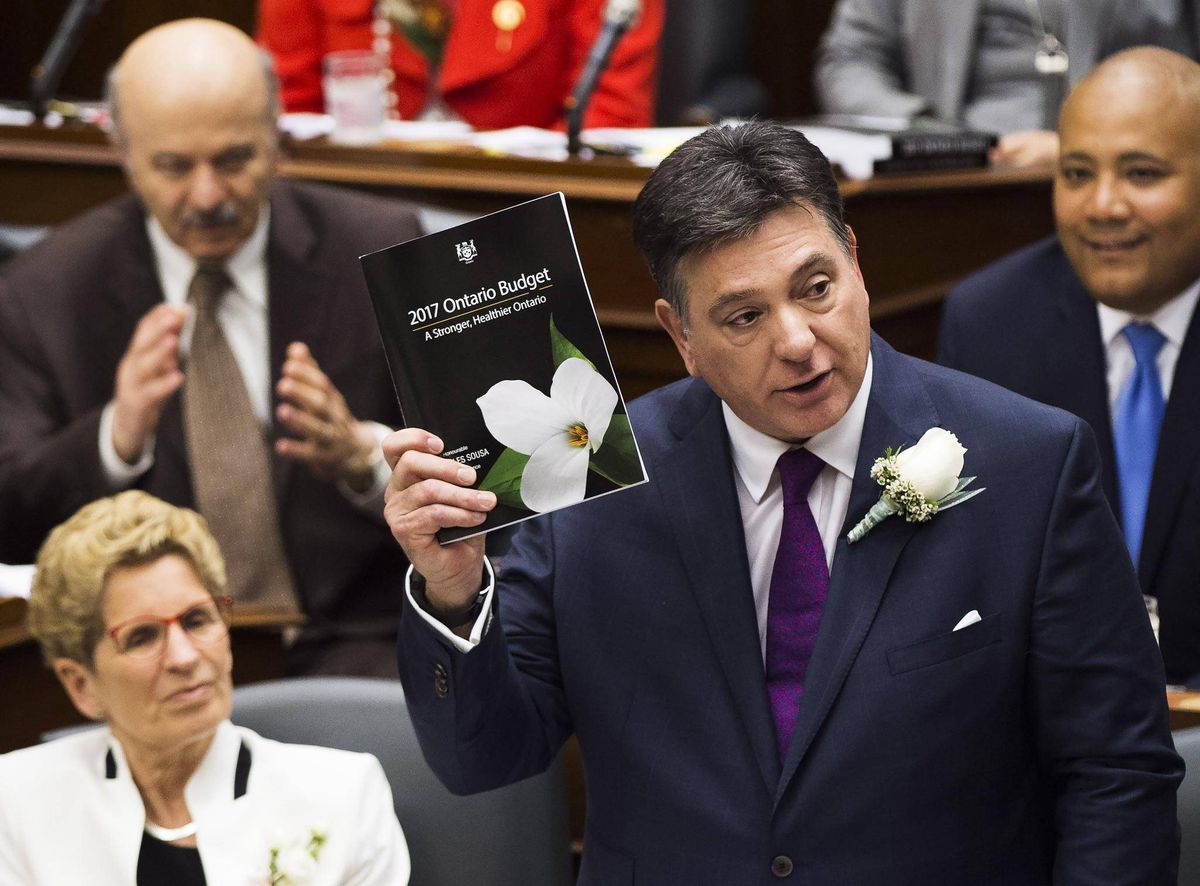

This attached presentation will give you quick answers to many questions relating to 2017 personal tax return and corporate tax planning. We list major changes to attached presentation, including income tax changes that have been announced but have not become law at this time. Click to view 2017 updates – 2017 Tax Updates